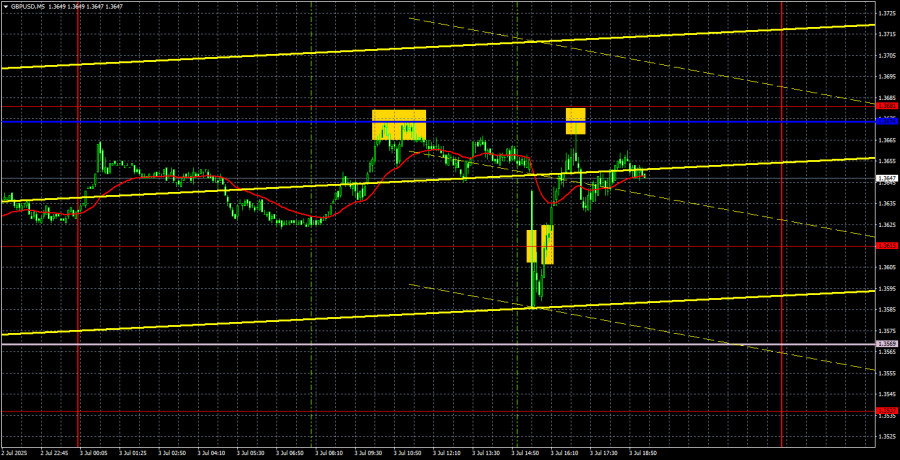

برطانوی پاؤنڈ/امریکی ڈالر کا 5 منٹ کا تجزیہ

جمعرات کو برطانوی پاؤنڈ/امریکی ڈالر کرنسی کے جوڑے نے یورو/امریکی ڈالر کے جوڑے میں تقریباً ایک جیسی حرکت دکھائی۔ یہ حیرت کی بات نہیں ہے، کیونکہ پچھلے پانچ مہینوں میں یہ یورو یا پاؤنڈ نہیں ہے جس کی قیمت میں اضافہ ہو رہا ہے، بلکہ ڈالر ہے جو گر رہا ہے۔ اس لیے، 95% معاملات میں، یہ ڈالر ہے جو یا تو گرتا ہے یا نہیں۔ اس ہفتے، برطانوی پاؤنڈ امریکی خبروں سے غیر متعلق عوامل کی وجہ سے صرف ایک بار دباؤ میں آیا۔ تاہم، ہم سمجھتے ہیں کہ بدھ کی کمی صرف مارکیٹ سازوں کی ہیرا پھیری تھی۔ جیسا کہ ہم نے دیکھا، جمعرات کو مضبوط امریکی اعداد و شمار پر بھی، ڈالر بنیادی طور پر اپنی ترقی کو جاری رکھنے میں ناکام رہا۔ اس طرح، ہم کہیں گے کہ امریکی ڈالر ایک اور گراوٹ کی تیاری کر رہا ہے۔ نیچے کی طرف تصحیح - جو بمشکل گھنٹہ وار ٹائم فریم پر شروع ہوئی تھی - تھوڑی دیر تک جاری رہ سکتی ہے۔ سب کے بعد، قیمت اہم Kijun-sen لائن کے ذریعے توڑ دیا. اس کے باوجود، ہم اب بھی ڈالر کی مضبوط ریلی پر یقین نہیں رکھتے جب تک کہ ڈونلڈ ٹرمپ اپنی پالیسیوں کا رخ تبدیل نہیں کرتے۔

تکنیکی نقطہ نظر سے، یہاں تک کہ گھنٹہ وار ٹائم فریم پر، ہم یہ نہیں کہہ سکتے کہ نیچے کی طرف ایک نیا رجحان شروع ہوا ہے۔ آخری اوپر کی لہر عملی طور پر بغیر کسی پل بیک کے تھی، اس لیے ٹرینڈ لائنز یا چینلز بنانے کا کوئی مطلب نہیں تھا - نیچے کی کوئی حرکت ان میں سے ٹوٹ جائے گی۔ اور پچھلے دو دنوں میں، ہم نے ایک تصحیح دیکھی ہے، لیکن قیمت ابھی بھی Senkou Span B لائن سے نیچے مستحکم ہونے میں ناکام رہی۔ لہذا، ہم سمجھتے ہیں کہ گھنٹہ وار چارٹ پر بھی اوپر کی طرف رجحان برقرار ہے۔

جمعرات کو کئی تجارتی سگنل بنائے گئے۔ شاید سب سے پر سکون کیجن سین لائن کے قریب فروخت کا پہلا سگنل تھا۔ امریکی اعداد و شمار کی اشاعت کے دوران، تاجر مختصر پوزیشنوں پر رہ سکتے تھے، لیکن جیسا کہ ہم نے پہلے ہی نتیجہ اخذ کیا ہے، ڈالر کی نمو مختصر مدت کے لیے تھی۔ 1.3615 کی سطح کے ارد گرد خریداری کے سگنل پر عمل کیا جا سکتا ہے، اور قیمت اہم لائن پر پہنچ گئی، اسے اچھال دیا، اور تاجروں کو مختصر پوزیشنوں پر دوبارہ منافع کی اجازت دی۔

سی او ٹی رپورٹ

برطانوی پاؤنڈ کے لیے COT رپورٹس بتاتی ہیں کہ پچھلے کچھ سالوں میں تجارتی تاجروں کے جذبات میں مسلسل تبدیلی آئی ہے۔ سرخ اور نیلی لکیریں، جو تجارتی اور غیر تجارتی تاجروں کی خالص پوزیشن کی نمائندگی کرتی ہیں، اکثر کراس کرتی ہیں اور عام طور پر صفر کی لکیر کے قریب رہتی ہیں۔ فی الحال، وہ ایک دوسرے کے قریب بھی ہیں، جو تقریباً مساوی تعداد میں خرید و فروخت کی پوزیشنوں کی نشاندہی کرتے ہیں۔ تاہم، گزشتہ ڈیڑھ سال کے دوران، خالص پوزیشن میں اضافہ ہوتا رہا ہے۔

ٹرمپ کی پالیسیوں کی وجہ سے ڈالر مسلسل کمزور ہو رہا ہے، جس کی وجہ سے مارکیٹ سازوں کے درمیان اس وقت کم متعلقہ مانگ ہے۔ تجارتی جنگ کسی نہ کسی شکل میں جاری رہے گی، اور آنے والے برسوں میں فیڈ کی کلیدی شرح سود میں نمایاں کمی ہو سکتی ہے - اقتصادی نقطہ نظر سے زیادہ۔ اس طرح، ڈالر کی طلب قطع نظر گر جائے گی۔ پاؤنڈ کے بارے میں تازہ ترین COT رپورٹ کے مطابق، "نان کمرشل" گروپ نے 6,400 خرید اور 2,000 فروخت کے معاہدے بند کیے ہیں۔ اس کا مطلب ہے کہ خالص پوزیشن 8,400 معاہدوں سے سکڑ گئی، لیکن اس کی عملی طور پر کوئی اہمیت نہیں ہے۔

2025 میں، پاؤنڈ میں تیزی سے اضافہ دیکھا گیا ہے، لیکن اس کی ایک بڑی وجہ ہے - ٹرمپ کی پالیسیاں۔ ایک بار جب یہ عنصر ختم ہوجاتا ہے، تو ڈالر کی بحالی شروع ہوسکتی ہے. لیکن جب ایسا ہوتا ہے، یہ کسی کا اندازہ ہے. ٹرمپ ابھی اپنی صدارت کے آغاز میں ہیں، اور اگلے چار سال مزید کئی جھٹکے لے سکتے ہیں۔

برطانوی پاؤنڈ/امریکی ڈالر کا 1 گھنٹے کا تجزیہ

فی گھنٹہ ٹائم فریم پر، برطانوی پاؤنڈ/امریکی ڈالر جوڑا تیزی سے گرا، لیکن بدھ کو کمی کی کوئی خاص وجوہات نہیں تھیں۔ جمعرات کو، اگرچہ وجوہات موجود تھیں، لیکن کمی واقع نہیں ہوئی۔ کمی Senkou Span B لائن کے قریب رک گئی، اس لیے یہ "ڈالر کی قیامت" کے اختتام کی نشان دہی کر سکتا ہے۔ خریداری کے لیے لیکویڈیٹی جمع ہو گئی ہے، اور اوپر کا رجحان جاری رہ سکتا ہے۔ اگر قیمت Senkou Span B سے نیچے مستحکم ہو جاتی ہے، تو یہ نیچے کی طرف تصحیح کے تسلسل کی نشاندہی کرے گا، حالانکہ اس منظر نامے کا فی الحال امکان نہیں ہے۔

4 جولائی کے لیے، ہم ٹریڈنگ کے لیے درج ذیل کلیدی سطحوں کو نمایاں کرتے ہیں: 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3615, 1.3741–1.3763, 1.3833, 1.3836. Senkou Span B (1.3569) اور Kijun-sen (1.3674) لائنیں بھی سگنل کی سطح کے طور پر کام کر سکتی ہیں۔ ایک بار جب قیمت 20 پِپس مطلوبہ سمت میں بڑھ جائے تو سٹاپ لاس کو بریک ایون پر سیٹ کرنے کی سفارش کی جاتی ہے۔ Ichimoku اشارے کی لکیریں دن میں بدل سکتی ہیں، لہذا تجارتی سگنلز کی شناخت کرتے وقت اس سے آگاہ رہیں۔

جمعہ کو، برطانیہ یا امریکہ میں کوئی اہم پروگرام طے شدہ نہیں ہے یہ ریاستہائے متحدہ میں عام تعطیل ہے۔ لہذا، ہم کم اتار چڑھاؤ اور فلیٹ حرکت کا مشاہدہ کر سکتے ہیں، خاص طور پر امریکی تجارتی سیشن کے دوران۔

تصاویر کی وضاحت:

سپورٹ اور مزاحمتی قیمت کی سطحیں - موٹی سرخ لکیریں جہاں حرکت ختم ہو سکتی ہے۔ وہ تجارتی سگنل کے ذرائع نہیں ہیں۔

Kijun-sen اور Senkou Span B لائنیں—یہ مضبوط Ichimoku اشارے کی لائنیں ہیں جو 4 گھنٹے سے گھنٹہ وار ٹائم فریم میں منتقل ہوتی ہیں۔

ایکسٹریم لیولز - پتلی سرخ لکیریں جہاں قیمت پہلے بڑھ چکی ہے۔ یہ تجارتی سگنل کے ذرائع کے طور پر کام کرتے ہیں۔

پیلی لکیریں - ٹرینڈ لائنز، ٹرینڈ چینلز، اور دیگر تکنیکی پیٹرن۔

چارٹس پر COT انڈیکیٹر 1 – تاجروں کے ہر زمرے کے لیے خالص پوزیشن کا سائز۔