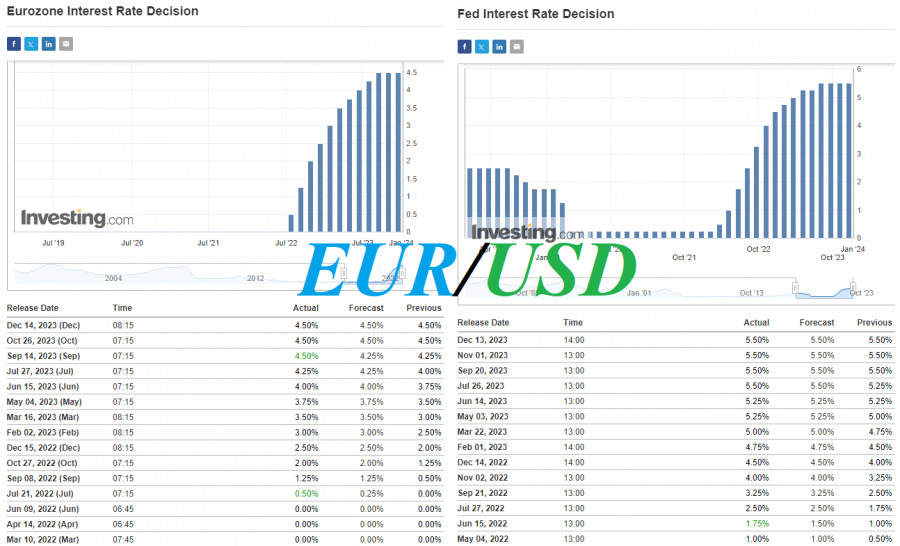

The markets have quieted down, and investors are in a waiting mode ahead of the publication (at 13:15 GMT) of the ECB's decision on interest rates. Looking ahead, it is widely expected that ECB leaders will not change the parameters of monetary policy and will maintain a cautious stance, leaving interest rates at their previous levels: the key rate at 4.50%, the deposit rate at 4.00%, and the marginal rate at 4.75%.

Eurostat recently reported that the final assessment of December consumer price indices in the Eurozone mostly matched the preliminary data, except for the core CPI. It turned out to be slightly higher than the preliminary estimate (+0.5% versus preliminary +0.4%). Overall, the Eurozone's annual CPI accelerated in December to +2.9% from +2.4% a month earlier (with a forecast of +3.0%), while the annual core CPI slowed down to +3.4% from 3.6% in November (with a forecast of +3.5%).

In turn, the inflation macrostatistics from Germany published last Tuesday also failed to support the euro: December's revised inflation data recorded no changes compared to November's data when the consumer price index was +0.1% (+3.7% on an annual basis).

The producer price index in Germany decreased in December from -0.5% to -1.2% and from -7.9% to -8.6% on an annual basis, exceeding expectations. The German industry remains under pressure from the decline in demand for products and the volume of orders, forcing companies to reduce prices.

Although the data indicates still high inflation in the Eurozone (the ECB's target consumer inflation level is close to 2.0%), there is also a trend of its slowdown (previous annual CPI values: +2.4%, +2.9%, +4.3%, +5.2%, +5.3%, +5.5%, +6.1%, +6.1%, +7.0%, +6.9%, +8.5%, +8.6% (in January 2023), while risks of recession persist.

The continuing slowdown of the overall European economy is also evidenced by the PMIs published on Wednesday. The preliminary PMI in the German manufacturing sector adjusted in January to 45.4 (from 43.3 earlier), the services sector to 47.6 (from 49.3 earlier), and the composite to 47.1 (from 47.4 earlier). The corresponding Eurozone PMI rose to 46.6 (against 44.4 in December and a forecast of 44.8), while in the services sector, it decreased in January to 48.4 (from 48.8 earlier with a forecast of 49.0). All indicators remain below the 50 mark, which separates growth in activity from a slowdown, indicating that business activity in the Eurozone continues to slow down. Economists believe that the downturn may be longer than previously expected.

The deterioration in the business climate was also evidenced by the IFO business climate index published today in Germany, which fell in January to 85.2 (from 86.3 in December with a forecast of 86.7). The index of assessment of current economic conditions was 87.0 (below the December figure of 88.5 and the forecast of 88.6), and the IFO expectations index, reflecting company forecasts for the next six months, fell to 83.5 from 84.8 earlier.

In other words, these data reinforce market expectations regarding today's neutral ECB decision on interest rates. The greatest interest will be in the press conference. It will begin at 13:45 (GMT), and ECB President Christine Lagarde will explain the bank's decision and likely outline near-term plans regarding monetary policy. It's possible that, as early as April or May, the ECB will begin to ease its policy and announce a reduction in the interest rate by 0.25%. If Lagarde speaks of such intentions of the ECB leadership, it is logical to expect a sharp fall in the euro and, consequently, in the EUR/USD pair. Conversely, a tough tone in her speech regarding the central bank's monetary policy will strengthen the euro.

But these are not all the main events of today's trading day.

Investors will also closely monitor data from the USA: At 13:30 (GMT), statistics on the dynamics of GDP for the 4th quarter of 2023 and the number of jobless claims will be published. The growth of the American economy in the 4th quarter is assumed to be +2.0%. This would give an average annual increase for 2023 in the range of 2.8%–3.0%. Strong U.S. GDP data could increase the likelihood not only of maintaining the Fed's interest rate at high levels for a longer time but also of another increase. However, weaker data could signal the Fed to lower borrowing costs. Most likely, this refers to the first half of this year.

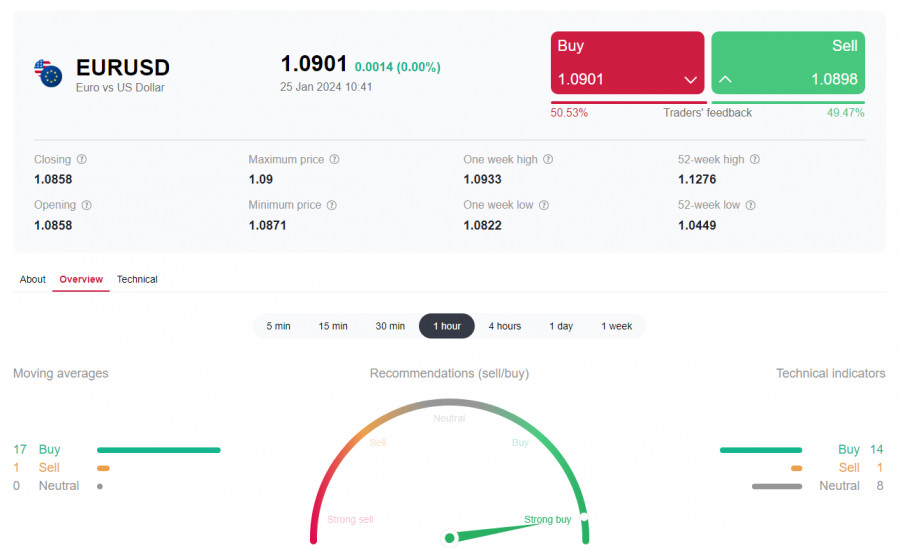

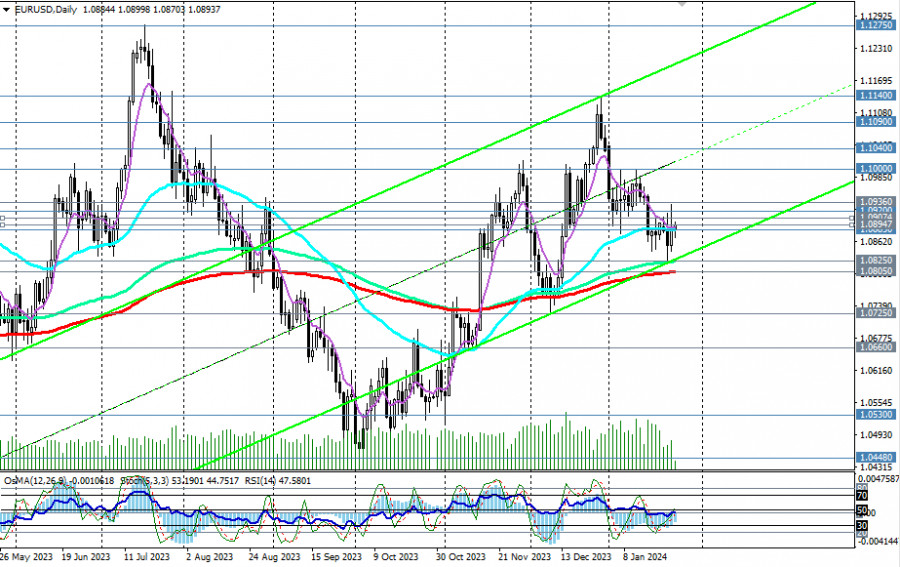

From a technical point of view, EUR/USD remains to trade in the zone of the medium-term bull market, above the key support level of 1.0805, and in the zone of the long-term bear market, below the key resistance level of 1.1000.

At the same time, technical indicators on the daily and weekly charts of the pair also show mixed dynamics. Thus, the outcome of today's ECB meeting could give the EUR/USD pair a new impulse for movement in either direction – in any.