The GBP/USD currency pair also continued its upward movement for most of Tuesday, pulling back slightly only in the second half of the day. The U.S. dollar remains in free fall, and listing all the reasons behind its decline would take an entire article. Among the latest "wonderful" developments for the dollar are the high likelihood of passing Donald Trump's "One Big Beautiful Bill," the lack of real progress in ending the trade war, and the market's general aversion to the U.S. currency. As mentioned earlier, the continued decline of the dollar under Trump is tantamount to a rebellion against the U.S. president. Market participants don't want to deal with the currency of a country led by Trump.

Meanwhile, tensions have once again flared up between former best friends Trump and Elon Musk. A few weeks ago, Trump and Musk were already openly clashing, although the conflict was eventually smoothed over. Earlier—just last year—they were friends, often appearing together publicly, and were regarded as the "architects of America's great future." However, by early 2025, it became clear that Trump had merely used Musk's money to win the election and then discarded him. Now that Musk is openly criticizing Trump's "One Big Beautiful Bill," he is practically being treated as an illegal immigrant, and his business is being portrayed as a massive drain on the U.S. budget through subsidies and grants.

Recently, Musk publicly stated that if the U.S. Congress approves the "One Big Beautiful Bill," then Republicans won't win a single seat in next year's midterm elections. The following day, Musk announced that if this "crazy bill" passes, he would form an American Party the very next day, aiming to fight both the "insane Republicans" and the passive Democrats. According to the head of Tesla and SpaceX, Americans no longer have a real say, and every election now boils down to choosing between two parties. Interestingly, it was Musk who financed Trump's election victory, presumably expecting to receive certain "perks" and preferences for himself and his businesses. But when Trump ultimately betrayed him, he openly launched a campaign against him.

From our perspective, Musk is no better than Trump. However, watching their public rivalry unfold is certainly entertaining, especially for those who aren't bullish on the dollar.

Trump has already responded to Musk, suggesting that he might have to "go back home to South Africa," because there will be no more rocket launches, satellites, or electric vehicle production. According to Trump, the U.S. economy would save a fortune by no longer subsidizing Musk's businesses. In short, the "American comedy" is just beginning. Many interesting events and headlines await us in the years to come. In the past, everyone wanted to come to the U.S.; now it seems that everyone wants to go anywhere except the U.S.

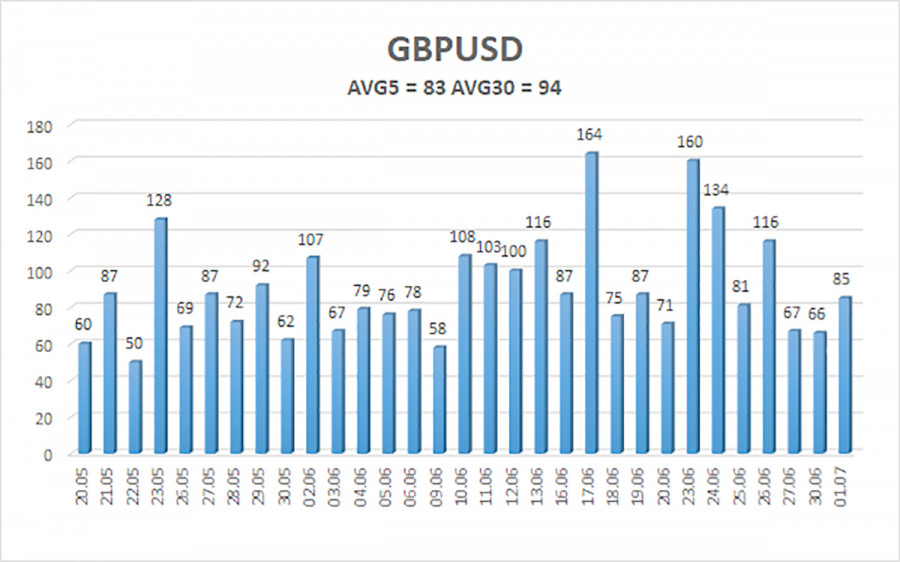

The average volatility of GBP/USD over the last 5 trading days is 83 pips, which is considered "moderate" for this pair. On Wednesday, July 2, we expect movement within the range defined by 1.3625 to 1.3791. The long-term regression channel points upward, indicating a strong bullish trend. The CCI indicator recently entered the oversold zone, triggering the resumption of the uptrend.

Nearest Support Levels:

S1 – 1.3672

S2 – 1.3611

S3 – 1.3550

Nearest Resistance Levels:

R1 – 1.3733

R2 – 1.3794

Trading Recommendations:

The GBP/USD pair maintains a bullish trend and has just completed another shallow correction. In the medium term, Trump's policies are likely to continue putting pressure on the dollar. Therefore, long positions with targets at 1.3791 and 1.3794 remain relevant as long as the price stays above the moving average.

If the price drops below the moving average, consider taking small short positions targeting 1.3625 and 1.3611. However, as before, we do not expect a strong rally in the dollar—only occasional corrections. For the dollar to enter a confirmed uptrend, there must be real signs of the Global Trade War ending.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.