Global markets at crossroads: investors nervous, dollar loses weight

World stock markets fell on Tuesday, with the MSCI index, which tracks stocks around the world, in the red. The main reason is growing investor frustration over the protracted US trade talks and the expectation of signals from the Federal Reserve. Against this background, the dollar also weakened against major currencies, reflecting a general decline in confidence in American economic policy.

Treasury bonds cause excitement

The unexpected surprise of the day was the auction of 10-year US Treasury bonds. Despite the general instability, the papers attracted a lot of interest from investors. Strong demand led to a drop in the yield of these bonds to the minimum of the day - a sign that the market is looking for a safe haven in the conditions of uncertainty.

Euro rises amid political upheaval in Germany

On the currency market, the euro strengthened after a rapid turnaround in German politics. Conservative politician Friedrich Merz, despite the first defeat, was elected chancellor of the Bundestag in the second round of voting. This unexpected outcome had a positive impact on the European currency, which strengthened against the dollar.

US and China: no talks for now

The key topic of concern in the markets remains the tension in global trade, especially between Washington and Beijing. China, the second economy on the planet, has previously expressed its willingness to consider the US proposal to resume negotiations. However, US Treasury Secretary Scott Bessent made it clear that, despite active negotiations with 17 countries, there have been no contacts with China yet. He also hinted that agreements with a number of countries could be announced this week, but did not specify which countries.

London and New Delhi find common ground

While the US is stalling in trade diplomacy, other countries are acting decisively. Britain and India signed a free trade agreement on Tuesday, a breakthrough that both sides had been working towards amid instability caused by US tariff policies. The new pact, which covers goods such as whiskey, cars and agricultural products, was an important step towards strengthening economic ties between the two countries.

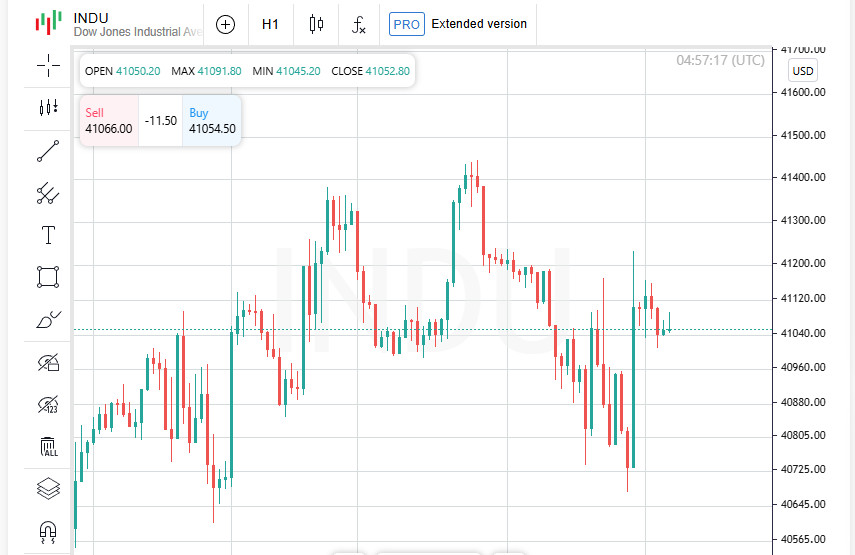

Wall Street under pressure: investors take losses

The US stock market ended Tuesday in the red. Investor indecision ahead of the Fed's statements and weak trade signals led to a wide-ranging correction:

- Dow Jones Industrial Average: down 389.83 points (-0.95%), closing at 40,829.00;

- S&P 500: down 43.47 points (-0.77%), ending the day at 5,606.91;

- Nasdaq Composite: down 154.58 points (-0.87%), ending at 17,689.66.

International markets also succumbed to the pressure:

- MSCI World: down 0.40% to 842.83;

- STOXX 600 (Europe): down 0.18%;

- DAX (Germany): ended the day down 0.4%, after an intraday drop of almost 2%.

All eyes on the Fed: markets hold their breath

Investors on both sides of the Atlantic are watching the US Federal Reserve meeting with anxious attention, the results of which will be known on Wednesday. The market does not expect a change in the key rate, but will closely study the regulator's rhetoric for hints of possible future easing of monetary policy. Even a hint of a reduction could trigger a rally, and its absence could increase volatility.

Dollar Loses Ground: Currencies Rise Amid Expectations

The dollar came under pressure as expectations of Fed easing grew. Currency markets reacted quickly, with notable moves:

Key Currency Moves:

- Dollar Index (DXY): down 0.62% to 99.19

- Euro: up 0.57% to $1.1378

- Yen: up 0.91% to 142.39 against the dollar

- Pound Sterling: up 0.64% to $1.3376

- Canadian Dollar: up 0.43% to C$1.38 per U.S. Dollar

Oil is regaining ground: demand is bringing bulls back to the market

Oil prices have confidently gone up after the recent collapse, when quotes reached four-year lows. Investors began to return to the market after signs of consumption recovery in Europe and China. An additional growth factor was the data on production cuts in the US and ongoing geopolitical tensions in the Middle East - all this fueled interest in "black gold".

Quotes at the close:

- WTI (USA): +3.43% ($1.96), final price - $59.09 per barrel;

- Brent (North Sea): +3.19% ($1.92), closing at $62.15 per barrel.

The market partially recovered the lost positions after the panic sell-off caused by concerns about increasing OPEC+ production. Now the focus is on the balance between production and consumption in the short term.

Gold Loses Its Gloss: Risk Appetite Pushes Safe Havens Away

Investors have started to flee safe havens amid improved expectations regarding the US-China dialogue. This has had an immediate impact on precious metals prices: gold, which had risen sharply the day before, is now under pressure.

Current dynamics in the precious metals market:

- Spot gold: down 1.2% to $3,388.67 per ounce (as of 02:25 GMT);

- Gold futures (US): -0.7% to $3,397.70.

Expectations of the Fed decision are also pushing traders to reconsider their gold positions. Despite a recent rise of almost 3%, the metal has corrected, reflecting the change in sentiment.

Silver and platinum are also in the red: the market is cooling

Amid the declining interest in gold, other precious metals have also suffered. Silver, as usual, follows its "big brother", while platinum and palladium continue to show a moderate decline amid weak industrial demand.

A quick overview of metals:

- Silver: -0.9%, to $32.93 per ounce;

- Platinum: -0.6%, to $979.07;

- Palladium: -0.4%, to $970.28.

The precious metals market remains extremely sensitive to macroeconomic signals and interest rates. If the Fed confirms that rates will remain unchanged, metals may partially recover their positions. Otherwise, the pressure will increase.