GBP/USD 5-Minute Analysis

On Thursday, the GBP/USD currency pair continued trading within the sideways channel, visible in the hourly timeframe. Two central bank meetings — each of which could be considered favorable for the U.S. dollar — failed to trigger either an exit from the flat phase or any significant dollar strengthening. Meanwhile, EUR/USD managed to end its three-week flat phase, despite having fewer objective reasons to decline on Wednesday and Thursday. As we've said before, market movements have practically no logic.

The only factor that could be considered a win for the pound over the past two days is Donald Trump's declaration of a trade agreement between the United Kingdom and the United States. However, there are no details about the deal—no information on the terms, tariffs, or obligations—so the cause for celebration seems highly questionable. In any case, many questions about the recent moves in both currency pairs remain unanswered.

Technically, Thursday's trading in the pair was chaotic. The pair rose, then fell, then rose again, then fell once more. We didn't mark any trading signals on the chart illustration because all movements took place in a zone cluttered with technical levels and Ichimoku indicator lines every 30–40 pips. Opening trades in between such tight levels was simply pointless.

COT Report

COT reports for the British pound show that commercial traders' sentiment has constantly shifted in recent years. The red and blue lines—representing net positions of commercial and non-commercial traders—frequently intersect and mostly hover near the zero mark. That's the case now, indicating a relatively balanced number of long and short positions.

On the weekly timeframe, the price initially broke through the 1.3154 level, then surpassed the trend line, returned to 1.3154, and broke it again. Breaking the trend line suggests a high probability of further pound depreciation. However, the dollar continues to fall due to Donald Trump. Therefore, despite technical signals, news about the trade war could keep pushing the pound higher.

According to the latest report on the British pound, the "Non-commercial" group closed 2,900 BUY contracts and 6,400 SELL contracts. As a result, the net position of non-commercial traders increased by 3,500 contracts.

The fundamental backdrop still does not justify long-term buying of the pound sterling, and the currency remains at real risk of resuming a broader downtrend. The pound has gained significantly recently, but it's important to understand that this was due to Donald Trump's policies.

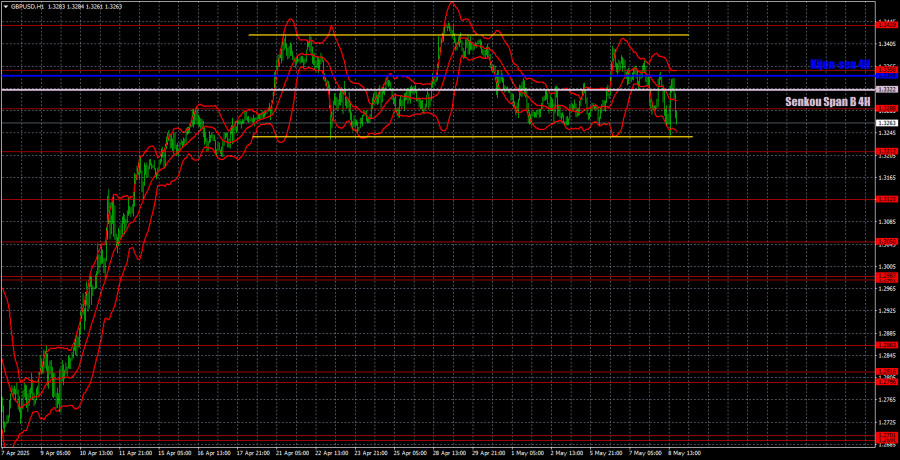

GBP/USD 1-Hour Analysis

The GBP/USD pair shows an upward trend on the hourly timeframe, as the three-week flat phase hasn't invalidated the ongoing bullish trend. The pound has demonstrated robust growth in recent months, though it can hardly take credit for it — the movement has resulted mainly from the weakening U.S. dollar triggered by Donald Trump. That downward pressure on the dollar hasn't ended. The UK-U.S. trade deal has been signed but hasn't helped shield the dollar from Trump's future policy decisions. The Bank of England has cut rates, but the market seems unwilling to acknowledge it. As such, the market remains in chaos and disarray, with little to no logical consistency in price action.

Key trading levels for May 9: 1.2691–1.2701, 1.2796–1.2816, 1.2863, 1.2981–1.2987, 1.3050, 1.3125, 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537. Ichimoku lines: Senkou Span B (1.3322) and Kijun-sen (1.3348) can also act as signal levels. To protect from false signals, place a Stop Loss at breakeven once the price moves 20 pips in the right direction.

No important events are scheduled in the UK or the U.S., aside from a speech by BoE Governor Andrew Bailey. It's unclear what new information Bailey could offer the day after the Bank's policy meeting, but officially, the event could still trigger some market reaction. A firm break below the flat range would indicate that — like the euro — the pound may be preparing for a decline. However, such a drop may be limited in scale.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.