The GBP/USD currency pair traded upward during the first half of Monday and downward during the second half. While the U.S. dollar didn't lose much this time, its brief attempt at strengthening was cut short as Donald Trump again stepped into the spotlight. On Monday, he declared that Hollywood was dying because other countries were luring away American studios with lower tariffs.

How does this work in practice? An American studio wants to shoot a movie but chooses foreign locations—which are cheaper—instead of filming in the U.S., where location fees go into the federal budget. As a result, millions or even billions of dollars don't make it to the U.S. Treasury, and Trump is not happy about that. The U.S. President didn't simply say he had found a new revenue stream for the budget—he insisted he was saving Hollywood. Saving it by forcing studios to film in America and pay enormous tariffs. And if a company chooses to film abroad, it will face a 100% import tariff on that content.

Essentially, the issue Trump "tackled" is the same across all industries: manufacturing in the U.S. is just too expensive. That's why phones are assembled in China or India, sports goods are stitched in Malaysia, and most electronics are produced in Asian countries. Trump fully understands that forcing companies to move production back to the U.S. could bankrupt many of them—but that doesn't concern him. He is dismantling a system that, according to many experts, helped make America wealthy.

The market, expecting nothing good to come from Trump's actions, continues to sell off U.S. assets. Of course, this process is not fast—there are simply too many U.S. assets out there, and despite Trump's first three months, the U.S. economy still isn't in dire shape. But this process has only begun and could continue for quite some time.

This week brings two central bank meetings—the Bank of England and the Federal Reserve. The dollar might get a boost if the Fed doesn't deliver any unpleasant surprises, like a rate cut—which can't be ruled out completely. However, the chances of a rate cut by the Fed are nearly zero. Jerome Powell, who "miraculously avoided being fired," has repeatedly said that the Fed needs to wait for clear economic signals before adjusting monetary policy. Powell and his colleagues have also said the rate may be lowered—or raised—this year depending on how the economy responds to Trump's tariffs and how long and painful their consequences are. As we see, Trump is still looking to impose tariffs on new sectors, while trade agreements with China and the EU are not in sight. Therefore, further deterioration of the situation remains likely.

The BoE's stance is more straightforward. Inflation in the UK has fallen to 2.6%, and last year, it even dipped to 1.7%. Inflation is no longer a serious concern for the BoE, so a rate cut is now on the table. The BoE's easing is a bearish factor for the pound—but only if the market chooses to react to it. Last week showed us that the market is fully capable of ignoring any information.

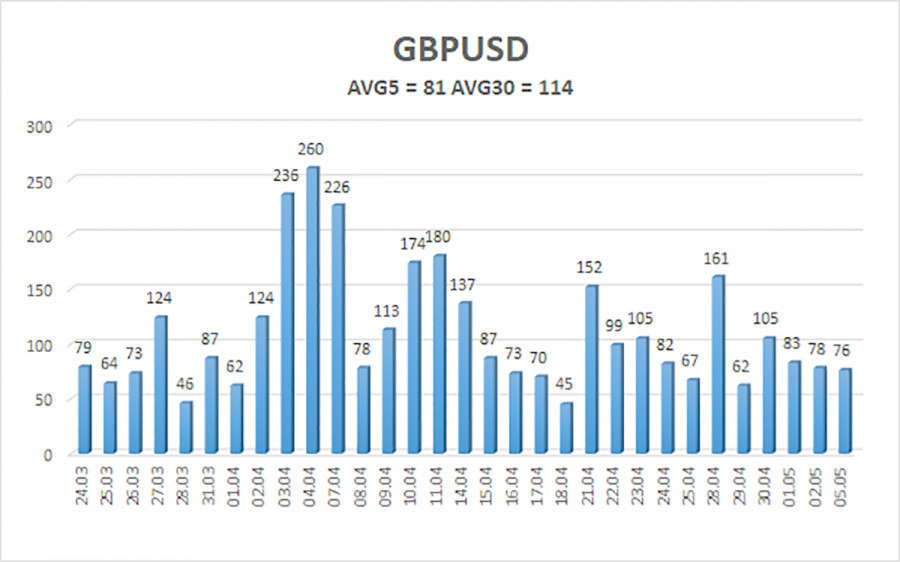

Over the last five trading days, the GBP/USD pair's average volatility stands at 81 pips, which is considered "average" for this pair. On Tuesday, May 6, we expect the pair to move within a range bounded by 1.3192 and 1.3354. The long-term regression channel points upward, indicating a clear bullish trend. The CCI indicator has formed a bearish divergence, which triggered the current decline.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair maintains its upward trend but has now settled below the moving average. We still believe the pound has no fundamental reason to rise. It's not the pound gaining value—it's the dollar declining, which has been going on for two months. And it's falling solely because of Trump. Therefore, Trump's actions could just as easily trigger a strong downward move—or another rally.

If you trade based on pure technicals or the "Trump factor," long positions remain relevant with targets at 1.3428 and 1.3550, provided the price is above the moving average. Short positions are still appealing, with initial targets at 1.3184 and 1.3167. The dollar's current four-day rally is already raising eyebrows—it appears we're witnessing a technical correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.