The GBP/USD currency pair also traded lower on Friday and even settled slightly below the moving average line. While we constantly say there are no reasons for the pound to fall except for Donald Trump, we remain very skeptical about the potential for the dollar to grow. Almost every day, news from the United States makes one thing clear — Trump is effectively unable to reach agreements with anyone. He can threaten and issue ultimatums, and weaker opponents will be forced to concede. But when a strong player appears on Trump's protectionist path, the Republican is unable to accomplish anything.

Trump promised to end the war in Ukraine within 24 hours. Then it became a week, then several months, now "by the end of the year," and it will all end with Trump simply losing interest in the topic, stating for the hundredth time that the war would never have started if he had been president. Trump hoped to use his influence to force Vladimir Putin and Volodymyr Zelensky to sign a ceasefire. In fact, he failed to influence either of them.

Trump promised to sign a host of favorable trade deals. First, he introduced "draconian" tariffs on imports, then handed out "grace periods" to encourage countries to negotiate more actively with Washington. Two months out of three have passed, but not a single trade deal has been signed.

Then came the story of Elon Musk, with whom the U.S. president also failed to resolve issues quietly and peacefully without "airing dirty laundry." Who has Trump actually managed to reach an agreement with?

But let's return to Friday and the macroeconomic data. The Nonfarm Payrolls report, the most anticipated release of the week, showed a decent figure for the second consecutive month. Many traders expected key macroeconomic indicators to collapse after the start of the trade war, but so far, only business activity indices and GDP have shown problems. Unemployment is not rising, jobs are steadily being created, and inflation is not accelerating.

Thus, somewhat unexpectedly for many, the dollar received decent support on Friday. Unfortunately, only nominally, as the dollar's increase did not exceed 40–50 pips. Formally, the dollar appreciated, but if it falls by 100 pips on Monday without any particular reason, we wouldn't be surprised. Of course, the dollar can rise occasionally because the price cannot always move in one direction. But it's one step forward, followed by three steps back.

The technical picture for the pound is best seen now on the daily time frame. The pair continues its four-month, nearly uninterrupted trend. Considering that a new conflict is brewing in the U.S., we would not expect the dollar to strengthen in the near future. It's important to understand that the conflict between Trump and Musk will further reduce the attractiveness of the U.S. economy and assets for investors.

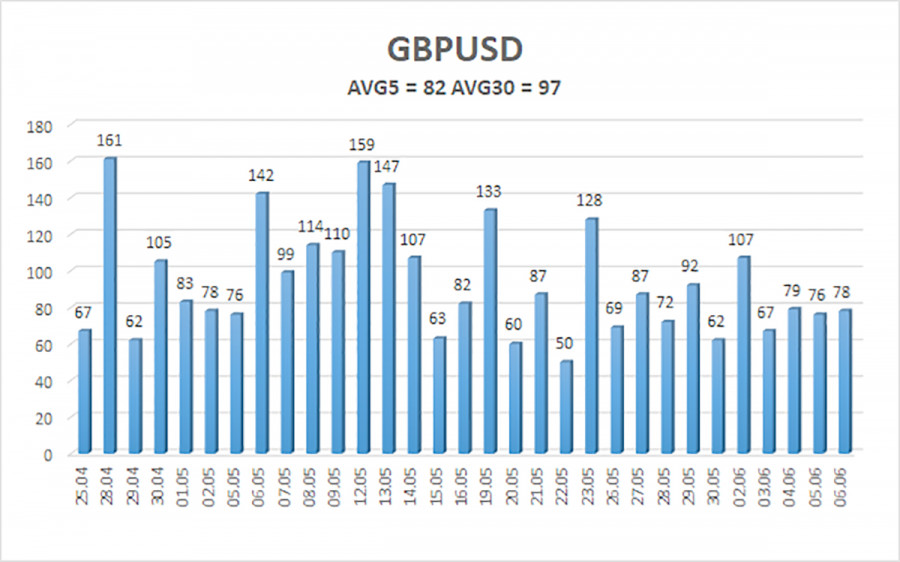

The average volatility of the GBP/USD pair over the last five trading days is 82 pips, which is considered "moderate" for the pound/dollar pair. On Monday, June 9, we expect the pair to move between 1.3441 and 1.3605. The long-term regression channel is pointing upwards, indicating a clear uptrend. The CCI indicator has not entered extreme areas recently.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair maintains its uptrend and continues to rise. There is plenty of news supporting this movement. The de-escalation of the trade conflict started and ended quickly, but the market's aversion to the dollar remains. Every new decision or event involving Trump is perceived negatively by the market. Thus, long positions are possible with targets at 1.3605 and 1.3672 if the price remains above the moving average. A move below the moving average line would allow consideration of short positions with targets at 1.3441 and 1.3428, but who now expects strong growth from the dollar? From time to time, the U.S. currency may show minor corrections, but for larger growth, real signs of de-escalation in the global trade war are needed.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.