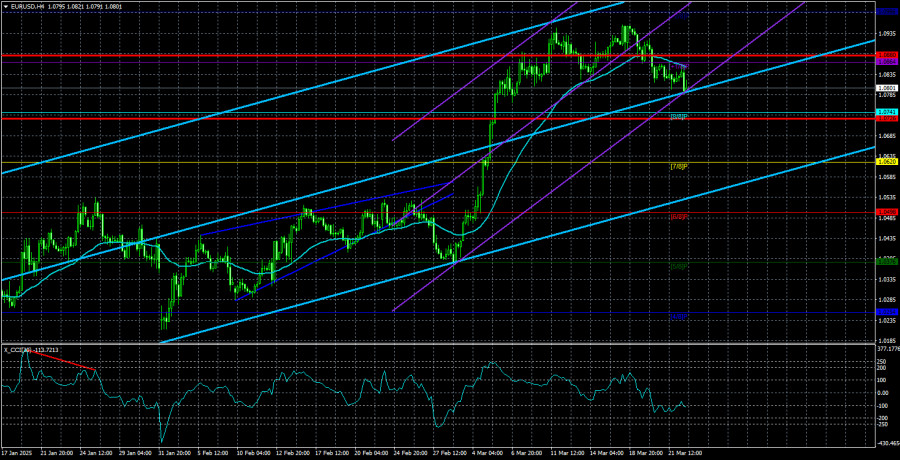

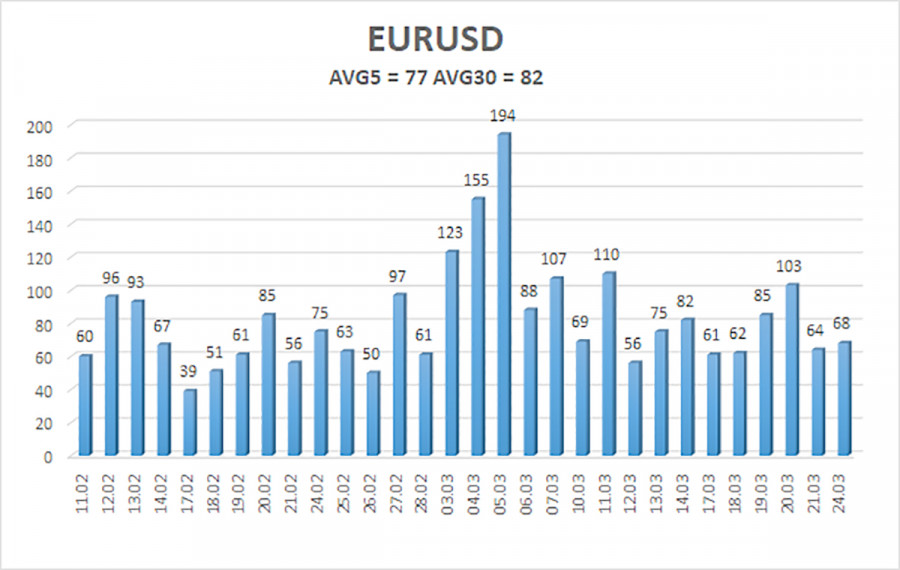

The EUR/USD currency pair showed relatively low volatility on Monday. However, looking at the chart below, it becomes clear that volatility hasn't been high recently—aside from a few days several weeks ago when Trump began actively imposing tariffs, the market reacted accordingly. Excluding those days, the euro typically moves about 60 pips daily, an average range for this pair.

On Monday, business activity indices in the services and manufacturing sectors were published in the EU, Germany, and the U.S., but these reports had no real chance of influencing market sentiment. The market always reacts to macroeconomic events; the question is whether this reaction will affect the broader technical and macroeconomic picture. In recent weeks, traders have been actively selling the dollar based on one single factor: Donald Trump's trade policy. Currently, the market shows little interest in business activity, monetary policy, unemployment, or inflation.

As a result, Monday turned out to be a frankly dull day. The price remained below the moving average line and continues to slide down. It's hard to call this move a "correction" because it's weak.

Can the dollar show more substantial growth under the current circumstances? It can—if the market stops focusing solely on potential future negative economic consequences that Trump's policies may trigger. Let's not forget that the European Central Bank is still actively cutting key rates, while the Federal Reserve is not. That's a highly significant factor. Without the U.S. president's involvement, we are confident the dollar would have continued to strengthen, just as it has for the past six months and the last 16 years.

However, predicting which tariffs or how many more Trump will introduce is impossible. Nor do we know how much longer the market will focus exclusively on this factor. If the current dynamic continues, the dollar could keep falling. It's worth noting that a "cheap" dollar works in Trump's favor, as it increases global demand for American goods. Trump's goal is clearly to sell more and buy less.

But there are two sides to every coin. Trump's policies—alongside those of his ally Elon Musk—are prompting global resistance to American goods. Regardless of the dollar's exchange rate, U.S. exports are more likely to decline than grow. Moreover, countries targeted by Trump's tariffs impose their own in response, increasing the cost of American products. For these reasons, it's hard to see what positive effect Trump can realistically achieve. Will he start threatening Europeans with war next if they don't buy American products? It's important to understand that it's not countries buying American whiskey or electric cars—it's European consumers. And if they don't want to buy them, they won't.

The average volatility of the EUR/USD currency pair over the last five trading days (as of March 25) is 77 pips, which is considered "moderate." We expect the pair to trade between 1.0726 and 1.0880 on Tuesday. The long-term regression channel has turned upward, but the global downtrend remains intact, as seen in higher timeframes. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest Resistance Levels:

R1 – 1.0864

R2 – 1.0986

Trading Recommendations:

The EUR/USD pair has exited the sideways channel and continues showing upward momentum. In recent months, we have consistently stated that we expect only a decline in the euro over the medium term, and nothing has changed in that regard. The dollar, other than Donald Trump, still lacks any fundamental reason for a medium-term decline. Short positions remain much more attractive, with targets at 1.0315 and 1.0254, although it is extremely difficult to predict when this irrational growth will end. If you trade based solely on technicals, long positions may be considered if the price remains above the moving average, with a target of 1.0986.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.