The EUR/USD currency pair experienced upward movement for most of Tuesday. One gets used to good news quickly, and the market expected further strengthening of the U.S. dollar. We anticipated dollar growth, believing that the initial success of talks between the U.S. and China is a positive sign.

Let's recall that the U.S. and China reached an agreement not even in the framework of formal negotiations, but during preliminary consultations for future talks. The first meeting between representatives of Beijing and Washington took place last weekend and resulted in a tariff reduction on both sides by about 80%. Where previously the countries had tariffs of 145% and 125%, now only "modest" 30% and 10% remain. Therefore, trade between the two largest economies in the world has resumed, and we believe this factor warrants a stronger market response than just a 100-pip rise in the dollar.

However, on Tuesday, the market chose to digest the news more thoroughly. It turned out that it's still too early to pop champagne over the end of the trade war. Yes, tariffs were reduced to minimal levels, but the trade war is not over, and these reduced tariffs are only set to last for 90 days. These 90 days will be dedicated to negotiations to finalize a deal, and there are no guarantees that the sides will reach an agreement.

It's worth remembering that during Trump's first term eight years ago, the U.S. president also initiated a trade war against China. What conclusions can be drawn from this? First, it is evident that Trump will have ongoing and enduring grievances against China. This means that in a few years, he could again claim unfair treatment and exploitation by China, leading him to impose new tariffs or sanctions. This situation is now clear to everyone, and China will certainly consider it during negotiations.

Second, eight years ago, the negotiations lasted over a year and a half, so there's no assurance that three months will suffice to finalize a substantial trade agreement. Thus, while the weekend brought a step toward de-escalation, a full resolution is still far off. Knowing Trump, anything could trigger a reversal—threats, accusations, ultimatums, tariffs. That's why the market is in no rush to buy the U.S. dollar.

It's also worth noting that the dollar has every reason to return to the 1.03–1.04 area if trade deals can be signed with the European Union and China. If that happens, Trump will be vindicated—now the U.S. would be trading on more favorable terms, and the economy should begin to grow faster and stronger. Logically, the dollar should return to where its decline started three months ago.

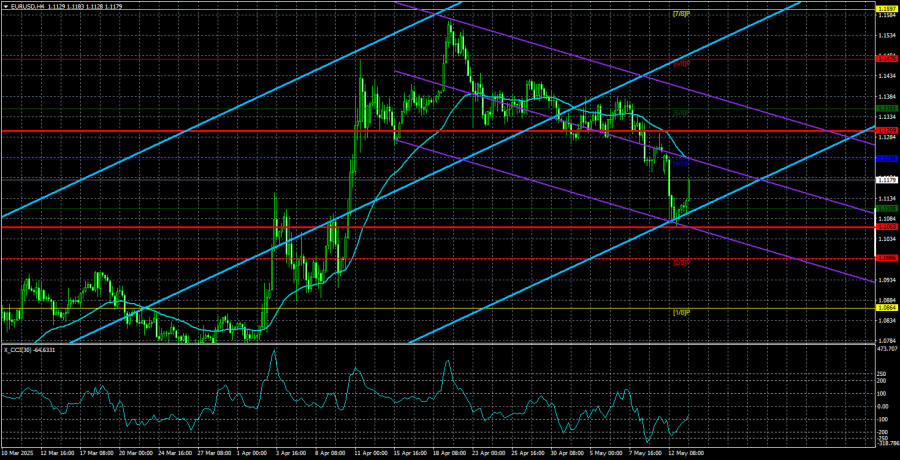

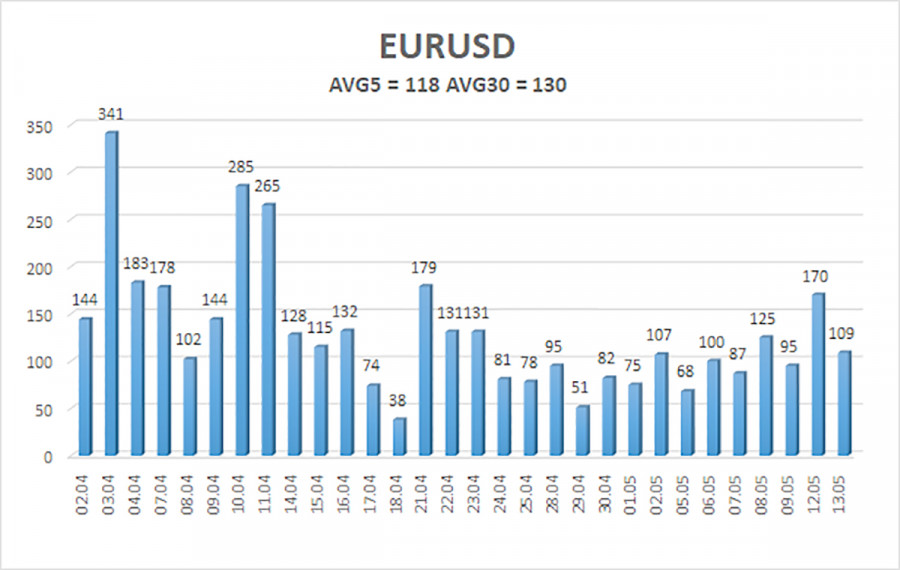

The average volatility of the EUR/USD pair over the past five trading days as of May 14 is 118 pips, which is classified as "high." We expect movement between the levels of 1.1063 and 1.1299 on Wednesday. The long-term regression channel still points upward, indicating a short-term uptrend. The CCI indicator entered oversold territory last week, which in an uptrend typically signals a trend continuation, but the trade war once again introduced volatility. Later, a bullish divergence formed.

Nearest Support Levels:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

Nearest Resistance Levels:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

Trading Recommendations:

The EUR/USD pair continues a downward correction within an overall upward trend. For months, we've maintained that we expect the euro to decline in the medium term, and nothing has changed in that outlook. The U.S. dollar still has no reason to fall, other than Donald Trump. Lately, however, Trump seems inclined toward a trade truce. As such, the trade war factor now supports the U.S. currency, which could quickly return to its starting point near the 1.03 level.

Given the current conditions, we do not consider long positions relevant. Short positions with targets at 1.1108 and 1.1063 remain relevant if the price is below the moving average.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.