The GBP/USD currency pair traded rather calmly on Wednesday, as there were few important events and reports during the day. As we expected, the business activity indices (excluding ISM) and the ADP report had almost no effect on trading. Most of the information received during the day related more to the general fundamental background on which the market builds long-term strategies.

So, on Wednesday, it became known that Trump increased tariffs on steel and aluminum for the whole world by 50%. Recall that the U.S. President had already announced this decision over the weekend, so the market had priced in this news with dollar sales on Monday. Yesterday's formal imposition of tariffs did not cause much reaction. At the same time, it was revealed that the new tariffs would apply to all countries except the United Kingdom. The White House stated that Britain would receive special treatment because of the Economic Prosperity Agreement signed between the two countries on May 8. Thus, for the UK, tariffs on steel and aluminum remain at 25%.

However, Trump's representatives indirectly confirmed that a full-fledged trade deal between London and Washington has not been finalized or signed. Washington stated that negotiations with British counterparts would continue until July 9, and tariffs could still be raised for the UK if the negotiation process fails. On the other hand, London declared its intention to achieve the complete removal of tariffs.

Frankly, the deal with London is the only one that seems more or less realistic. While the agreement hasn't been finalized yet, Trump has already announced a deal multiple times, and it appears that London and Washington will eventually reach an agreement.

What does this mean for the pound and the dollar?

For the dollar, a trade deal with the UK (not the largest U.S. trading partner) won't make much of a difference. The dollar needs tariff reductions in conflicts with the EU and China to truly rally. For the British pound, however, it's another opportunity to continue strengthening against the dollar.

The British economy still doesn't show high growth rates, and Trump's tariffs could hurt it. Therefore, if Britain avoids the fate of other countries, its economy at least won't be under the pressure of tariffs, unlike others. Why wouldn't the market continue to invest in the pound?

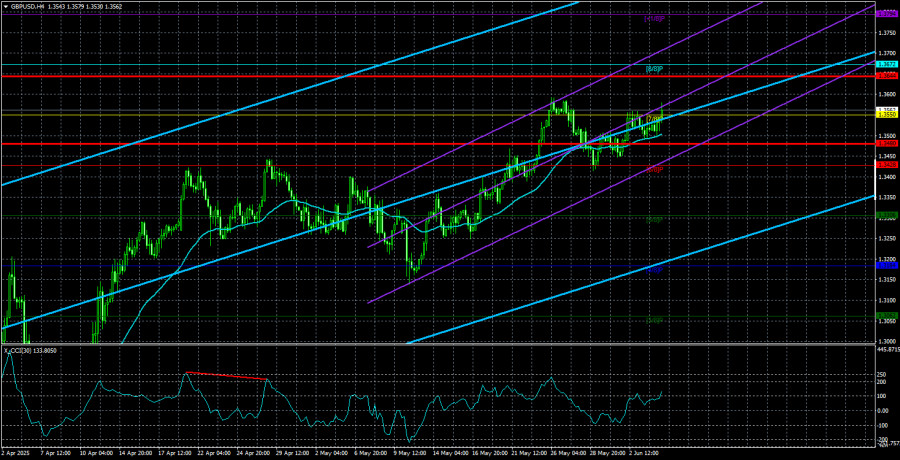

From a technical perspective, the GBP/USD pair remains near its local and three-year highs and still shows no strong desire to correct. Thus, the British currency could show a new "surge" at any moment. If the U.S. labor market and unemployment data disappoint, we might see that surge this week.

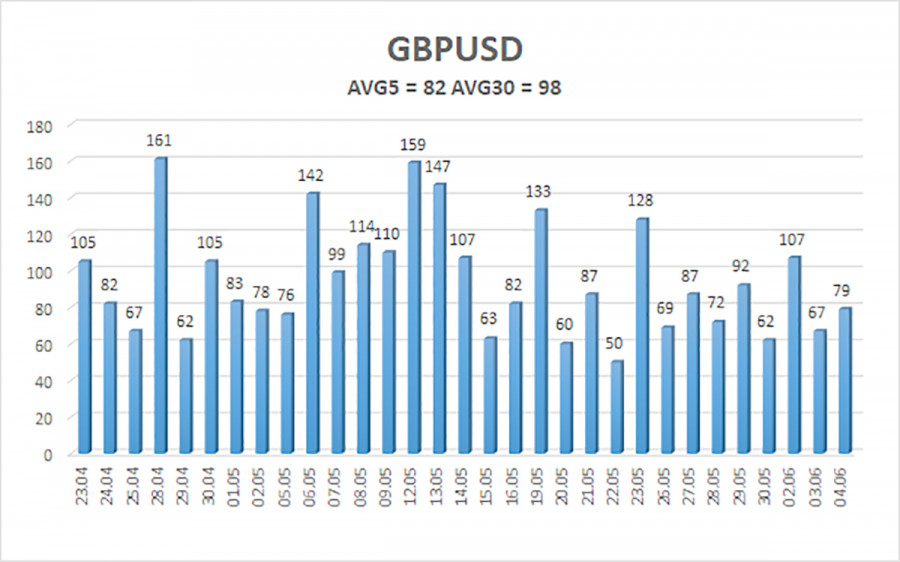

The average volatility of the GBP/USD pair over the last five trading days stands at 82 pips, which is considered "moderate" for this pair. Therefore, on Thursday, June 5, we expect the pair to move within the range limited by 1.3480 and 1.3644. The long-term regression channel points upward, indicating a clear uptrend. The CCI indicator has not entered extreme zones recently.

Nearest Support Levels:

S1 – 1.3550

S2 – 1.3428

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3672

R2 – 1.3794

R3 – 1.3916

Trading Recommendations:

The GBP/USD pair maintains its uptrend and continues to grow. There is plenty of news supporting this movement. The de-escalation of the trade conflict started and ended quickly, but the market's hostility toward the dollar remains. Every new decision by Trump or related to Trump is perceived negatively by the market. Therefore, long positions are possible with targets at 1.3644 and 1.3672 if the price stays above the moving average. A consolidation below the moving average would allow considering short positions with targets at 1.3428 and 1.3306. But who expects a strong dollar rally right now? Occasionally, the dollar might show minor corrections. However, real signs of de-escalation of the global trade war are needed for a more sustained rally.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.