The GBP/USD currency pair continued its strong upward movement throughout Thursday. Since the beginning of the week, the U.S. dollar has lost "only" 330 pips. As we've previously stated, the market simply could not react differently to the circus staged by Trump around the Iran-Israel conflict, especially since the war seems to have been put on pause for now. And if there's no tension in the Middle East, then the so-called "safe-haven dollar" (which in reality no longer plays that role) is of no interest to anyone. The trade war is not approaching a resolution but rather a new escalation. After a brief correction, the market once again rushed to sell the American currency — without any apparent reason.

This week also featured two speeches by Jerome Powell in the U.S. Congress, but they sparked no interest among traders. That's because the Federal Reserve Chair didn't say anything new. He still believes that it's not the right time to lower the key interest rate, as the final tariffs remain unclear, and their overall impact on the U.S. economy is uncertain. The Fed cannot make forecasts for the main macroeconomic indicators and sees no reason to make changes when the level of economic uncertainty is off the charts.

And what kind of speech could interest traders? Of course — a speech by Trump. First, the U.S. President once again called Powell an "idiot." Then he claimed that "ever-sluggish Powell" is costing the U.S. economy $800 billion a year (due to his refusal to cut the key rate) and that the Fed's rate should be 2–3% lower. But these were just routine attacks on the Fed Chair, the same kind we saw eight years ago during Trump's first term. However, yesterday at the NATO summit in The Hague (and don't ask why Trump was talking about Powell at a security summit), the U.S. leader said he is extremely dissatisfied with Powell and already has three or four candidates in mind to replace him.

It's worth noting that Powell's term expires next year, and he will leave his position regardless. However, until then, Trump (unsurprisingly!) still cannot fire him — just like before. So, for five months straight, we've been hearing how bad and stupid the Fed Chair is and that Trump is going to fire him every other week — but in reality, nothing changes because the Fed is exactly that rare sphere where Trump has no direct influence. Launching a strike on Iran without Congress? No problem. Deploying troops to quell protests in Los Angeles? Sure. Imposing global tariffs against half the world? Go ahead. But firing Powell? Nope.

We're being sarcastic here, of course, because technically, Trump also lacks the authority to do most of those things. The U.S. Congress must approve decisions of that scale. However, over the past five months, Congress might as well be meeting in a park somewhere, sipping coffee on benches, because Trump has been making all the key decisions, bypassing them. In short, if anyone thinks that Powell's latest round of criticism triggered the dollar's collapse, they're mistaken. If only because the dollar has been falling since the start of the week — and Trump has already "fired" Powell about 10 or 20 times.

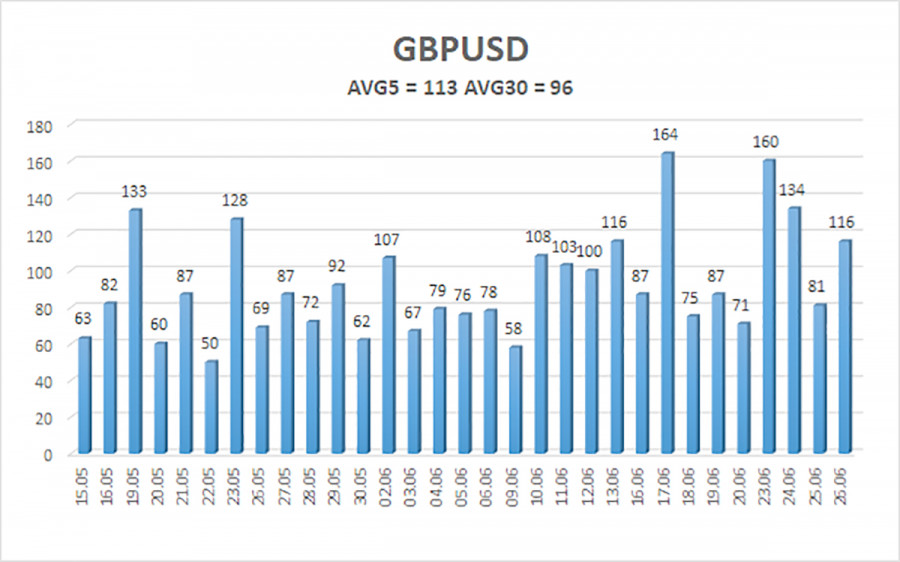

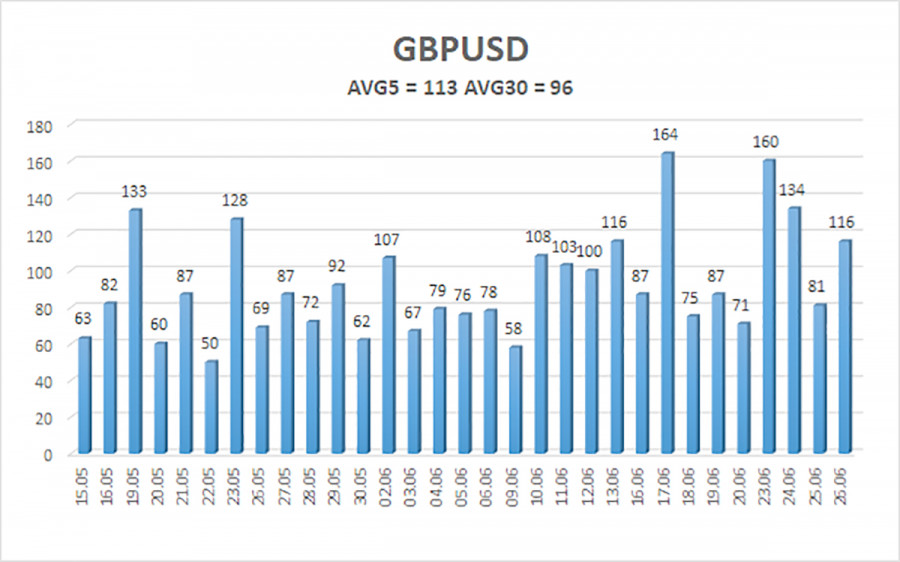

The average volatility of GBP/USD over the last 5 trading days stands at 113 pips, which is considered "moderate" for this pair. Therefore, on Friday, June 27, we expect movement within the range between 1.3645 and 1.3871. The long-term regression channel is directed upward, indicating a clear uptrend. The CCI indicator dipped into the oversold zone, which ultimately triggered the resumption of the bullish trend.

Nearest Support Levels:

S1 – 1.3733

S2 – 1.3672

S3 – 1.3611

Nearest Resistance Levels:

R1 – 1.3794

Trading Recommendations:

The GBP/USD currency pair maintains a bullish trend and has completed another minor correction. In the medium term, Trump's policies will likely continue putting pressure on the dollar. Thus, long positions with targets at 1.3794 and 1.3871 remain relevant as long as the price stays above the moving average. If the price moves below the moving average line, small short positions with targets at 1.3550 and 1.3489 may be considered. However, as before, we don't expect a strong dollar rally. The U.S. currency may occasionally experience corrections, but a sustained recovery would require real signs that the global trade war is ending.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.