The GBP/USD currency pair plummeted on Wednesday like a stone. However, every drop in the pair eventually gives way to a much stronger rise. Therefore, at this point, there's no real reason to speculate on the outlook for the U.S. dollar—there isn't one. Of course, at some point, a correction will begin. The dollar can't depreciate forever. It's possible that the correction could be even significant. However, at this moment, neither the fundamental background nor technical analysis suggests any substantial dollar strength.

The annual economic forum is taking place in Sintra, Portugal, where Andrew Bailey, Jerome Powell, and Christine Lagarde have already spoken several times. As we warned earlier, the heads of the Bank of England, Federal Reserve, or European Central Bank have provided no significant or new information. However, Jerome Powell finally responded to Donald Trump's ongoing criticism during one of his speeches.

Powell indirectly made it clear that, had it not been for Donald Trump's tariffs, the Fed would have continued its monetary easing in 2025. He also openly stated that Trump's tariffs have not only influenced and will continue to influence the economy, but they have also completely disrupted the economic forecasting process, on which key interest rate decisions are based. Powell indicated that the reason for the prolonged pause in easing lies in Trump's policies—his weekly changes to import tariffs and the constantly shifting tariff rhetoric. "We managed to lower inflation to 2.3%, but then we saw the size of the import tariffs and decided to pause," Powell stated.

The Fed Chair also confirmed that the Fed will continue to take a wait-and-see approach until the U.S. president finalizes import duties for all countries on his "blacklist." "The threat of rising inflation remains very high, so we are not going to rush into decisions that we might later have to reverse," Powell said.

However, Powell also hinted at a possible rate cut in the second half of the year. He noted that any signs of weakness in the labor market would force the Fed to shift toward a more dovish policy. No such signs are evident yet, but this Friday will bring unemployment and Nonfarm Payrolls data. Those reports may form the basis for the July 30 rate decision. These are the final reports before the next meeting. Still, the probability of a rate cut is higher in September.

In our view, it simply means another leg down. If the dollar has already been falling for five months amid monetary easing by the BoE and ECB, and with the Fed maintaining its policy, what can be expected if the Fed also begins cutting rates? Thus, no matter how you look at it, we see no prospects for the U.S. currency in 2025. The trade war theme remains unresolved, and tariffs will continue to be applied to the majority of U.S. imports, regardless of the outcome.

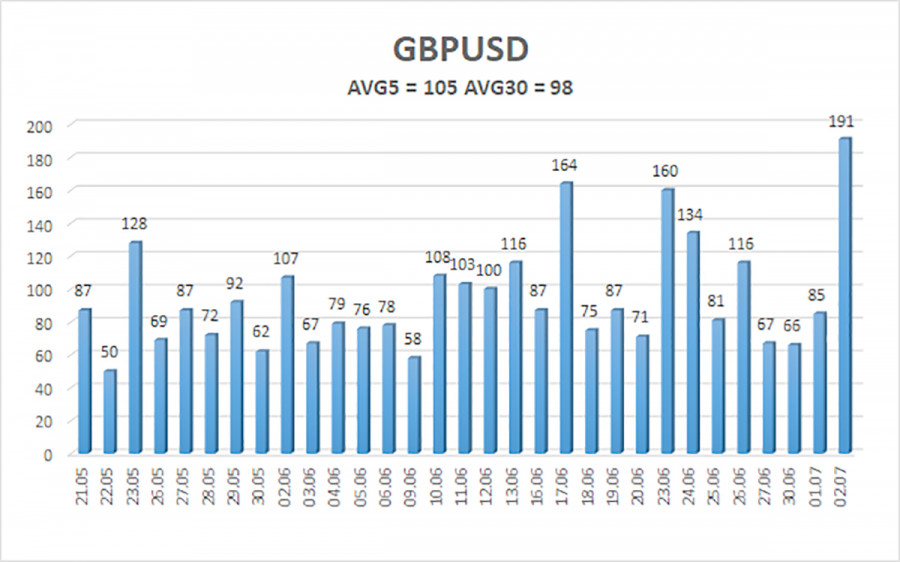

The average volatility of the GBP/USD pair over the past five trading days is 105 pips, which is considered "moderate" for the pair. On Thursday, July 3, we expect movement within the range of 1.3534 to 1.3744. The long-term regression channel is pointing upward, clearly indicating a bullish trend. The CCI indicator entered the oversold area for the second time recently, again suggesting the resumption of the uptrend.

Nearest Support Levels:

S1 – 1.3611

S2 – 1.3550

S3 – 1.3489

Nearest Resistance Levels:

R1 – 1.3672

R2 – 1.3733

R3 – 1.3794

Trading Recommendations:

The GBP/USD pair maintains its uptrend and has completed another mild correction. In the medium term, Trump's policies are likely to continue putting pressure on the dollar. Thus, long positions with targets at 1.3733 and 1.3794 remain relevant as long as the price holds above the moving average. If the price falls below the moving average, short positions may be considered, with targets at 1.3550 and 1.3534; however, we still do not expect strong dollar growth. From time to time, the U.S. currency may only show brief corrections. For a sustained rally, it would need clear signs of an end to the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.