Analysis of Trades and Trading Tips for the British Pound

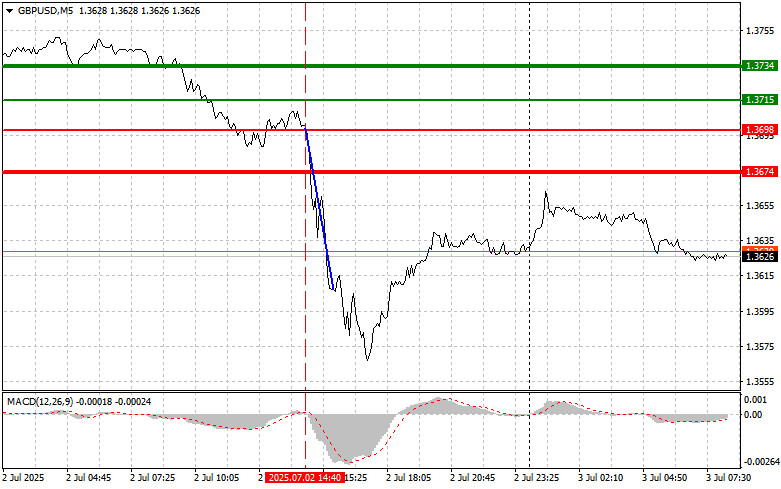

The test of the 1.3698 price level coincided with the moment when the MACD indicator had just begun to move downward from the zero mark. This confirmed the correct entry point for selling the pound, resulting in a decline of over 100 points.

The British pound reacted with a sharp drop following reports that the UK government is facing a potential budget shortfall of £22 billion. This sudden financial challenge, emerging amid existing concerns over inflation and economic growth prospects, triggered a wave of selling of the pound. Investors, already worried by recent economic reports indicating a slowdown in growth, saw the news of the budget gap as a red flag. Questions about how the government plans to fill this gap — whether through tax hikes, spending cuts, or a combination of both — added to market uncertainty.

Today, pressure on the pound may persist after the release of weak UK services PMI and composite PMI data. If the published figures come in below expectations, they will only intensify concerns about the slowing economy and the potential for further tightening of the Bank of England's monetary policy. Negative PMI data could impact the pound in two ways. First, it directly signals a deterioration in business activity in key sectors, reducing the appeal of British assets. Second, it may prompt the BoE to reassess its interest rate strategy, as the current wait-and-see approach and quarterly rate cuts could exacerbate the economic downturn.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

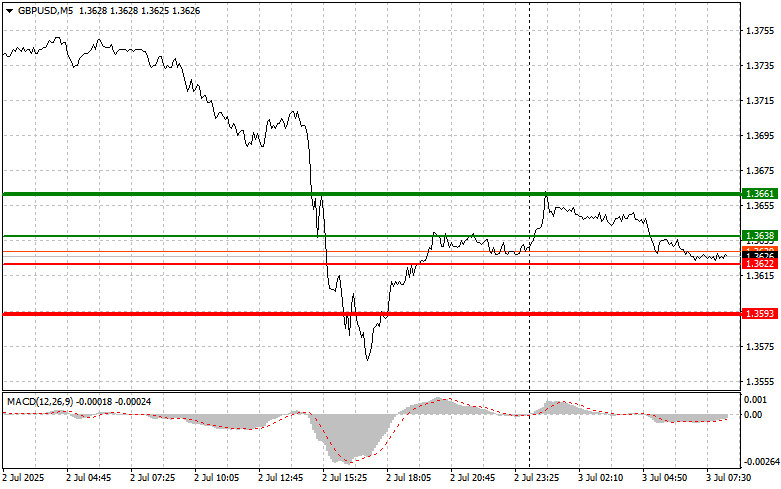

Scenario #1: I plan to buy the pound today at the entry point around 1.3638 (green line on the chart), aiming for a rise to 1.3661 (thicker green line on the chart). Near 1.3661, I intend to exit long positions and open short ones in the opposite direction (expecting a 30–35-point retracement). Buying the pound today is only viable after strong data releases.

Important: Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3622 level while the MACD is in oversold territory. This will limit the pair's downward potential and lead to an upward reversal. A rise to 1.3638 and 1.3661 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after breaking below the 1.3622 level (red line on the chart), which should trigger a rapid decline in the pair. The sellers' key target will be 1.3593, where I intend to exit short positions and immediately open long ones (expecting a 20–25-point rebound). Selling the pound is justified after weak data in continuation of yesterday's trend.

Important: Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3688 level while the MACD is in overbought territory. This will cap the pair's upside potential and trigger a reversal downward. A drop to 1.3622 and 1.3593 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.