The EUR/USD currency pair spent Thursday calmly drifting lower. We continue to wait for the current correction to end and for the uptrend to resume. To be fair, this correction could last quite a while. Over the past two weeks, the market has revealed several key insights. Let's briefly outline them.

First, market participants continue to ignore roughly 80% of positive news for the U.S. dollar. This indicates that sentiment toward the dollar remains negative. Second, the market is not currently pricing in Trump's next round of tariff hikes—scheduled for an unspecified future date. The U.S. president is known for changing his stance multiple times a day, so there is no confidence that tariffs will actually be raised for more than 20 countries starting August 1. The same applies to tariffs on copper, pharmaceuticals, and other categories also planned for that date.

The dollar continues to rise in what is purely a corrective movement that requires no special justification. Simply put, even the dollar needs to be corrected from time to time. Given that the U.S. currency has been falling for over five months, a longer corrective phase is plausible. Still, we do not expect a significant or sustained strengthening of the dollar.

If Donald Trump were to simply stop and leave things as they are now, there might be a chance that the worst is behind us and that the markets just need to adjust to a new trade reality. However, Trump continues to raise tariffs, introduce new ones, and issue new threats. In other words, no one believes that he's reached the final stage of this global trade war escalation. If that's the case, we are likely to see many more rounds of sanctions, tariffs, and ultimatums—followed by occasional "pardons." Can the dollar rally strongly under these circumstances?

This week, traders themselves may have realized that Trump is doing everything he can to avoid a new escalation of the trade conflict. How else to explain the repeated delays in implementing tariffs? Recall that in early April, Trump announced tariffs on 75 countries but immediately set a three-month grace period with minimal rates—for negotiations. This week, he raised tariffs on more than 20 countries, but the increases won't take effect until August 1, even though the negotiation deadline passed on July 9. Why the delay?

Because the U.S. president likely doesn't want to impose them either. He and his team must understand that tariffs will have a negative impact on the U.S. economy—and Jerome Powell has shown no intention of easing monetary policy to bail out the administration. Thus, the longer the trade war continues, the greater the risk of a slowdown in the U.S. economy. It's doubtful that the full effect of the tariffs has been reflected in Q1 data. We believe the first quarter merely laid the groundwork for a deeper economic slowdown.

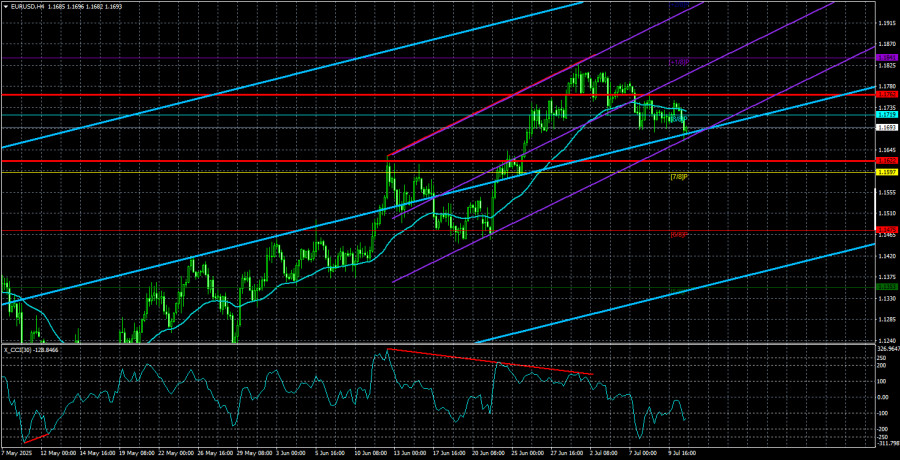

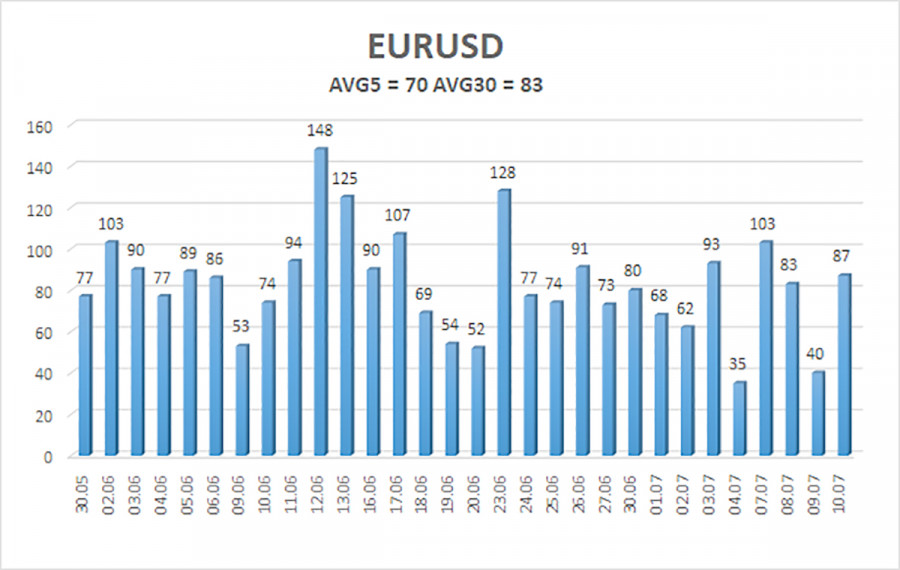

The average volatility of the EUR/USD pair over the past 5 trading days, as of July 11, is 70 points, classified as "average." On Friday, we expect the pair to move within the range of 1.1622 to 1.1762. The senior linear regression channel remains upward-sloping, indicating that the trend is still bullish. The CCI indicator entered the overbought zone and formed several bearish divergences, triggering the current downward correction.

Nearest support levels:

- S1 – 1.1597

- S2 – 1.1475

- S3 – 1.1353

Nearest resistance levels:

- R1 – 1.1719

- R2 – 1.1841

- R3 – 1.1963

Trading Recommendations:

The EUR/USD pair remains in an uptrend. U.S. dollar performance continues to be strongly affected by Donald Trump's policies—both foreign and domestic. The market still shows no willingness to buy the dollar under any circumstances. If the price is below the moving average, small short positions may be considered with a target of 1.1622, although a major drop under current conditions is unlikely. Long positions remain valid above the moving average, with a target of 1.1841 in line with the prevailing trend.

Illustration Explanations:

- Linear regression channels help determine the current trend. When both point in the same direction, the trend is considered strong.

- The moving average line (settings 20,0, smoothed) shows the short-term trend and the recommended trading direction.

- Murray levels are target points for trend movements and corrections.

- Volatility levels (red lines) show the probable price channel for the next 24 hours based on current volatility metrics.

- The CCI indicator entering oversold (below -250) or overbought (above +250) zones signals a likely trend reversal.