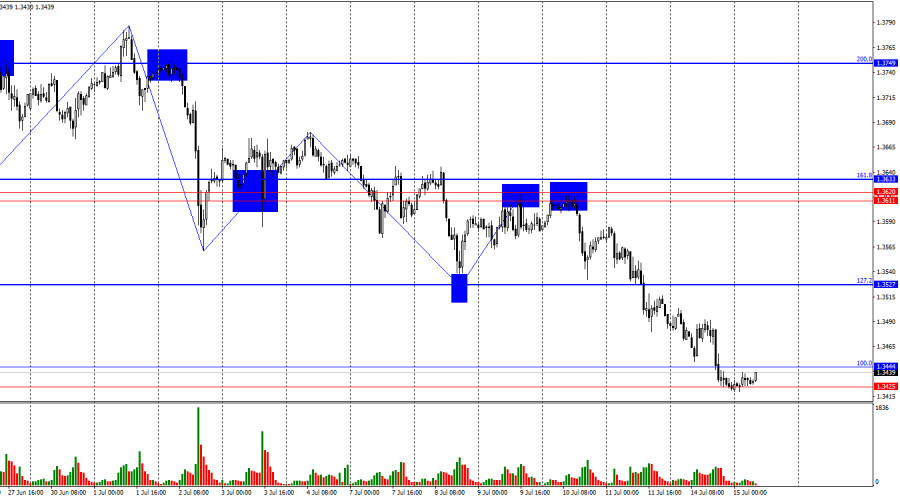

On the hourly chart, the GBP/USD pair continued to decline on Monday and by the end of the day had reached the support zone of 1.3425–1.3444. A rebound from this zone would work in favor of the British pound and lead to a rise toward the 127.2% Fibonacci level at 1.3527. A close below the 1.3425–1.3444 zone would increase the likelihood of a further decline toward the next support zone at 1.3357–1.3373.

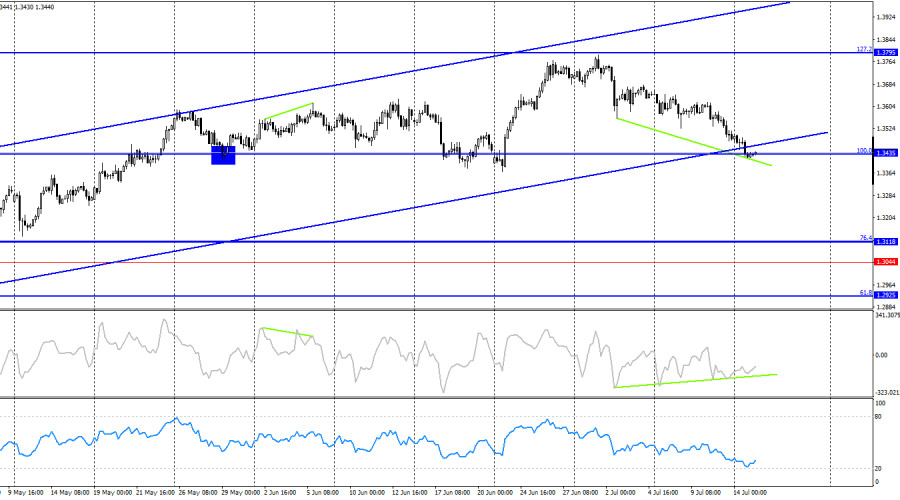

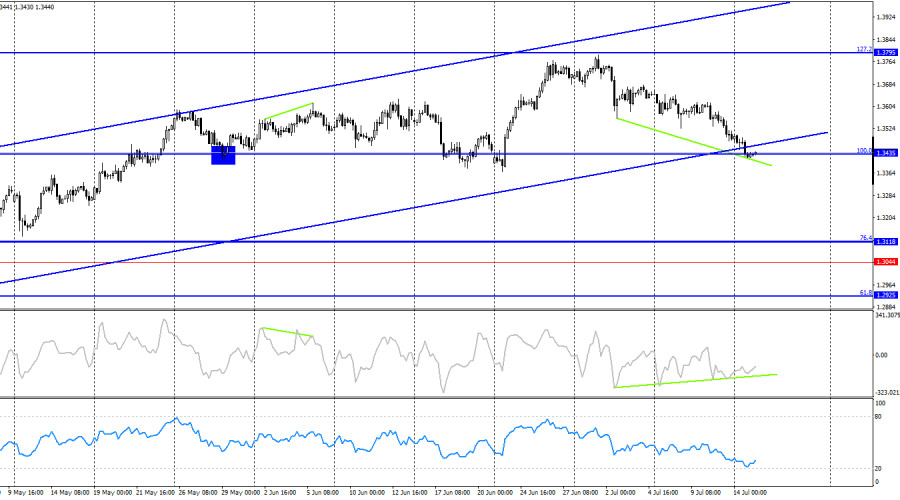

The wave structure still indicates that the bullish trend remains intact. The last completed upward wave broke above the previous wave's high, while the three new downward waves have not updated that low. Thus, what we are seeing now is not a trend reversal to bearish, but rather a series of waves within a fairly strong correction that traders haven't seen in quite some time. Bears still lack compelling reasons to go on the offensive, as Trump's trade war continues to escalate by the day.

Today, the U.S. will release the June inflation report, which is of great interest to traders but won't change the fundamentals of the Fed's monetary policy. As a reminder, Trump continues to pressure the Fed and Jerome Powell personally to lower the interest rate by at least 3%. Trump needs a "soft" monetary policy to offset the negative effects of tariffs. However, the Fed and Powell have their own mandates—price stability and full employment—which do not particularly concern the U.S. president. Therefore, the Fed refuses to cut rates and instead emphasizes accelerating inflation in recent months, which it expects to continue rising through the end of the year due to Trump's tariffs. Thus, an inflation increase today would confirm Powell's concerns about accelerating consumer price growth. If that happens, the chances of a rate cut in July or September would drop to nearly zero. I wouldn't say this information is critically important for the dollar, which has been declining since the beginning of the year for reasons unrelated to inflation or Fed policy. Nevertheless, traders might take this report into account.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar just a few points short of the 127.2% retracement level at 1.3795. Since the decline was unexpected and may be short-lived, I believe it is better to analyze the hourly chart for now. A rebound from the 100.0% retracement level at 1.3435 would favor a resumption of the bullish trend. No developing divergences are observed on any indicator.

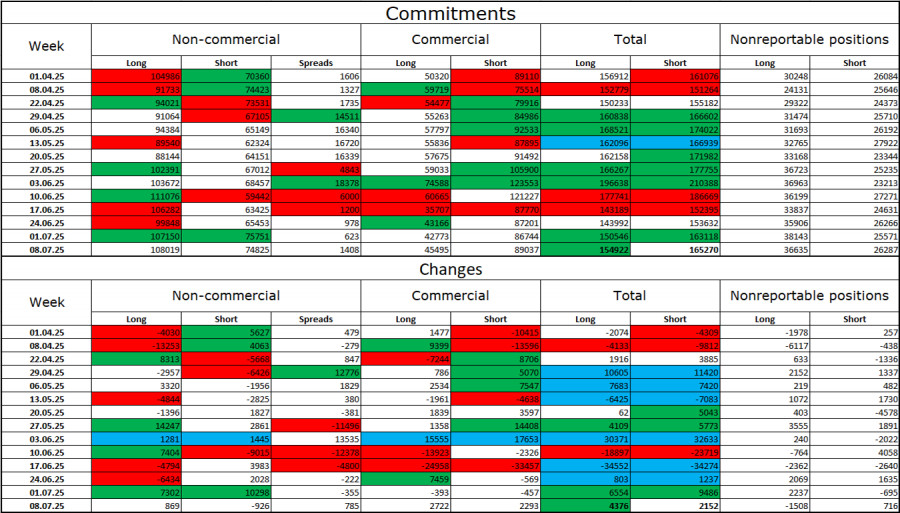

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became slightly less bullish over the latest reporting week. The number of long positions held by speculators increased by 7,302, while short positions rose by 10,298. However, bears have long since lost the upper hand in the market and currently stand no chance of success. The gap between long and short positions is 32,000 in favor of the bulls: 107,000 versus 75,000.

In my view, the British pound still faces downside risks, but events in 2025 have completely shifted the market's long-term direction. Over the past four months, the number of long positions has grown from 65,000 to 107,000, while short positions have decreased from 76,000 to 75,000. Under Donald Trump, confidence in the dollar has weakened, and the COT reports show that traders are reluctant to buy it. Thus, regardless of the broader informational backdrop, the dollar continues to decline amid developments surrounding Trump.

News calendar for the U.S. and U.K.:

U.S. – Consumer Price Index (12:30 UTC)U.K. – Speech by Bank of England Governor Andrew Bailey (20:00 UTC)

On Tuesday, the economic calendar features two very important events. The impact of the news background on trader sentiment is expected to manifest in the second half of the day.

GBP/USD forecast and trading tips:

Selling opportunities were present upon a rebound from the 1.3611–1.3633 zone with a target of 1.3527. That target has been achieved. New sell opportunities emerged following a close below 1.3527 on the hourly chart with a target of 1.3444. That target has also been met. Buy positions can be considered upon a rebound from the 1.3425–1.3444 zone with targets at 1.3527 and the 1.3611–1.3633 zone.

Fibonacci level grids are constructed from 1.3446–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.